What Are 529 Plans?

Originally created in 1996, Qualified Tuition Plans — commonly referred to as 529 plans or 529 college savings plans — are tax-advantaged savings plans designed to make it easier to save for college or other post-secondary training. The moniker of “529 Plans” refers to section 529 of the Internal Revenue Service (IRS) code, which provided for the establishment of these plans.There are two different types of 529 plans, but each must be set up with a designated beneficiary. The first type, a prepaid tuition plan, can generally be used to purchase credits or other approved units at participating colleges and universities. When the student begins attending school, they can use these prepaid credits toward tuition and fees. These plans can be beneficial because they lock in tuition prices at eligible schools. However, they are limited on what they can be used for and where they can be used. Many also have restrictions on the age or grade of the beneficiary.

College Savings Plans, on the other hand, tend to be more flexible. Tuition rates are not locked in because the funds are not designated for specific schools. There are no age limits on who they can be opened for and they can be used to cover all “qualified higher education expenses,” including:

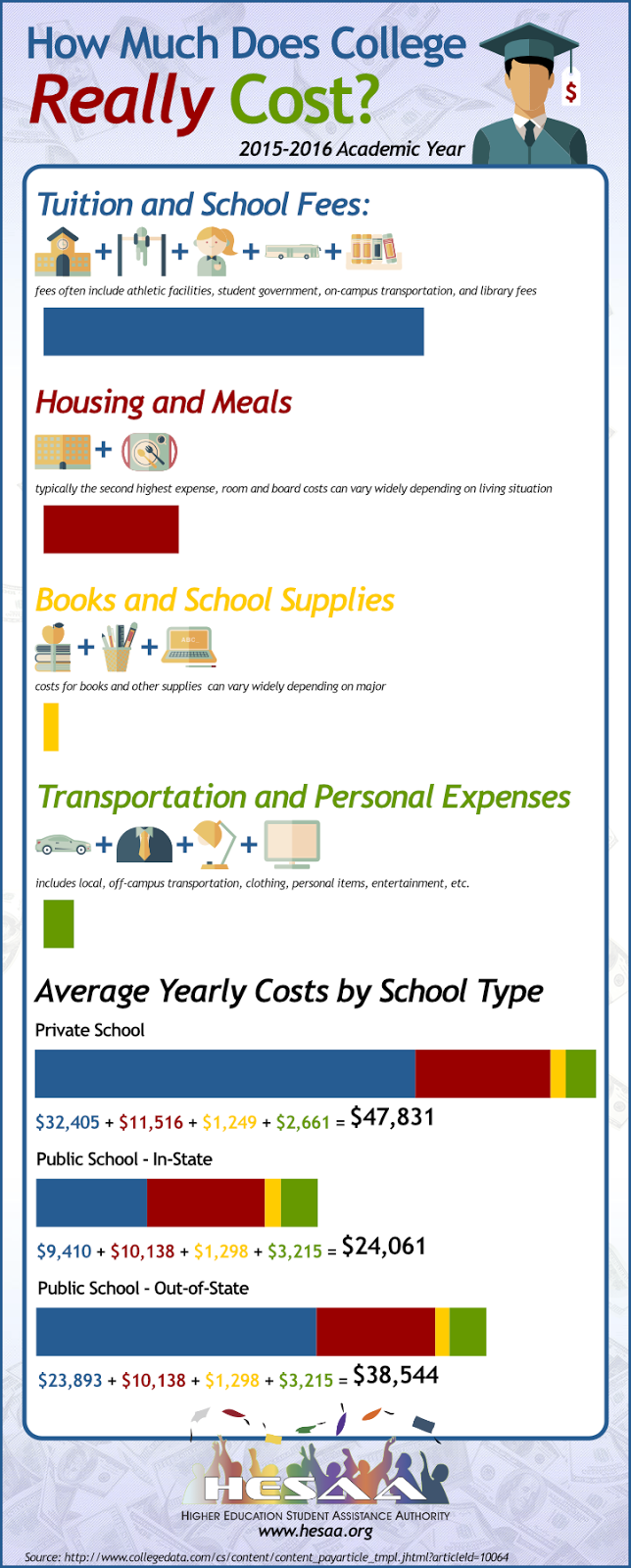

- Tuition and Fees

- Room and Board

- Required Books and Computers

NJBEST: The New Jersey 529 College Savings Plan

The New Jersey Better Educational Savings Trust, NJBEST for short, is a 529 College Savings Plan created by the state of New Jersey. It has the flexibility of all 529 College Savings Plans, but also offers some exclusive benefits just for New Jersey residents.Flexible Savings

First, you don’t have to worry about your savings being wasted. You, as the plan owner, get to decide how and when your assets are spent on higher education expenses. In fact, if your chosen beneficiary chooses not to pursue higher education, you have the ability to use the funds to educate another family member (read the Investor Handbook for details). And, since the funds can be used at any accredited college, you don’t have to worry about what school the student chooses to attend.Potential Scholarship of up to $1,500

In addition to your savings, the NJBEST program offers students the potential of receiving a college scholarship of up to $1,500. This tax-free scholarship is available to many students at New Jersey colleges and universities. The value of the scholarship increases with the time and investment of your NJBEST savings plan.Limited Interference with New Jersey Financial Aid Eligibility

One key feature of the NJBEST 529 College Savings Plan is that there is limited interference with other New Jersey Financial Aid. The plan is structured so that the first $25,000 in savings is excluded from the criteria used to determine financial aid eligibility in the state of New Jersey.Low Minimum Contribution - High Contribution Limits

You don’t have to be able to save a lot to get started. In fact, you can start your NJBEST savings plan with as little as $25. Once started, you can continue to make contributions to your college savings plan until the plan’s value reaches $305,000, making sure that you can save plenty of money for your future student’s education.Tax Advantages

Your NJBEST savings plan grows free from federal income tax and New Jersey state income tax. Qualified withdrawals are not typically subject to these taxes either. If others wish to make a large contribution to your beneficiary’s 529 savings plan, there is often special gift and estate tax treatment. A single-year contribution of up to $70,000 ($140,000 if given by a married couple) is generally excluded from federal gift and estate taxes. However, the contributor can make no further gifts to the beneficiary for five years under these circumstances.College is expense and the rising cost of tuition means that it will only get more so. You can invest in your child’s future by opening a 529 Plan.

Sources:

https://www.sec.gov/investor/pubs/intro529.htmhttps://www.irs.gov/uac/529-plans-questions-and-answers

- Investing in NJBEST savings plans does not guarantee admission to any college, either in New Jersey or elsewhere.

- NJBEST scholarships are awarded during a beneficiary’s first year of college.

- Tax benefits are conditioned upon meeting certain requirements. Nonqualified withdrawals and particular circumstances may not result in tax benefits. Always consult a tax advisor before investing.

- As with any investment, 529 plans have risks associated with them that can cause investment return and principal to fluctuate.

- Please read the Investor Handbook for more information on NJBEST College Savings Plans.